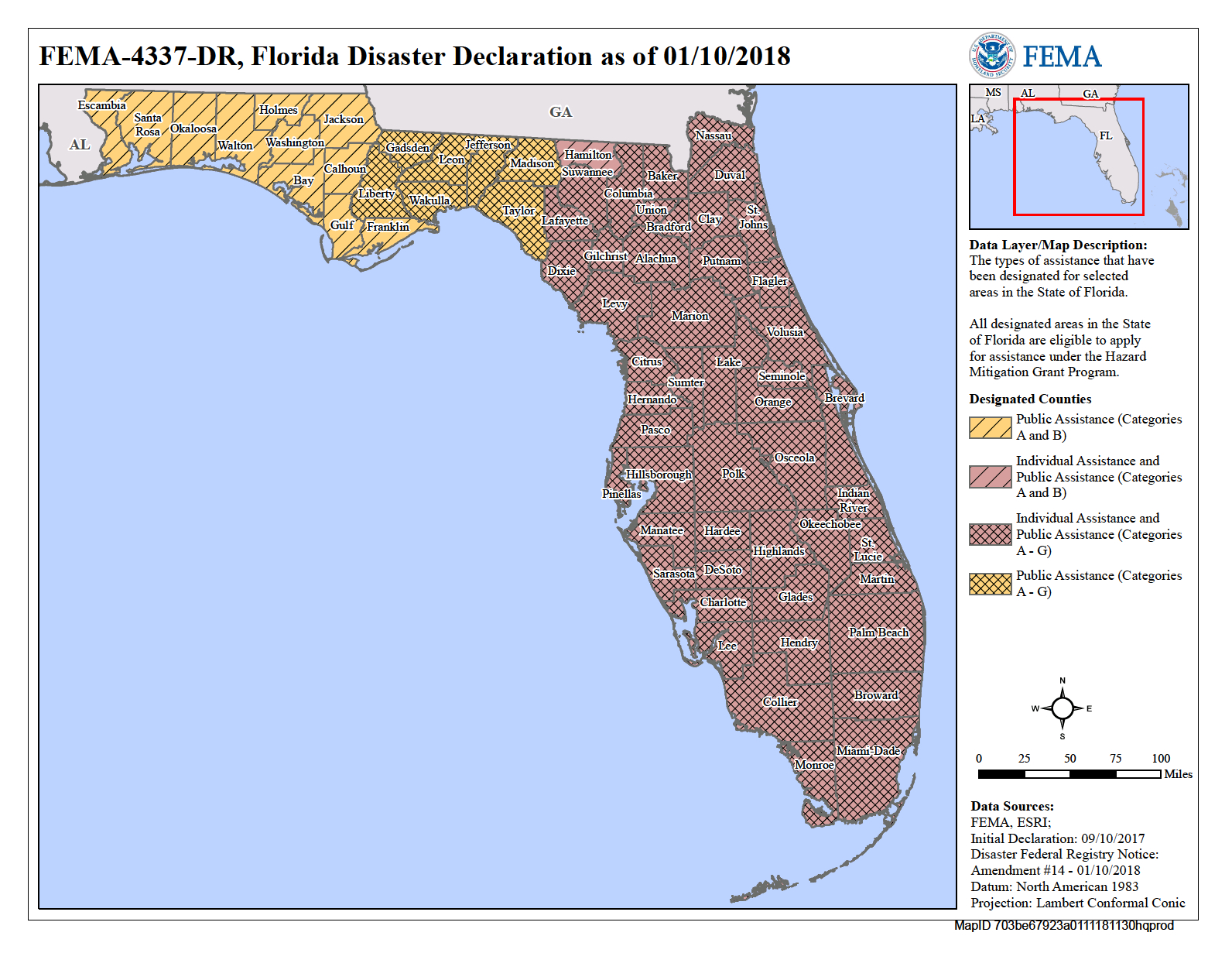

The issue of how many people go uninsured for flooding is vital, said Chad Berginnis, executive director of the Association of State Floodplain Managers. The agency painted a different picture however at the end of the year when it sent a report to the treasury secretary and a handful of congressional leaders saying higher prices would drive a fall off of 1 million policies compared to the beginning of the decade. The next month FEMA told the AP those figures were “misleading” and “taken out of context” and that on the subject of how many people will be insured “there is no study or report to share.”

It’s a response in part to criticism that taxpayers were funding big payouts when coastal mansions in risky locations flooded.īut nine senators from both parties expressed “serious concerns” about the new pricing system in a letter last September, after hearing that the agency’s internal numbers predicted policies would drop off by 20%.

Fema flood zone update#

LOUIS (AP) - When questioned by members of Congress, the Federal Emergency Management Agency said its new update to the nation’s flood insurance program will prompt more people to sign up for coverage, even though many will pay more for it.īut in a FEMA report obtained by The Associated Press under the Freedom of Information Act, the agency estimates one million fewer Americans will buy flood insurance by the end of the decade - a sizable number of people at risk of catastrophic financial loss.Īs climate change drives increased flood risk in many parts of the country, FEMA has updated its flood insurance program to more accurately reflect risk, but also make the program more solvent. Flood insurance purchase is not mandatory.ST. Zone X-ShadedĠ.2 percent Annual Chance Flood Hazard Zone Xįlood insurance rate zones that are outside the flood plain or the average flood depths of less than one foot. Mandatory flood insurance requirements apply. Zone VEįlood insurance rate zone that corresponds to coastal areas that have additional hazards associated with storm waves. Mandatory flood insurance purchase requirements apply.

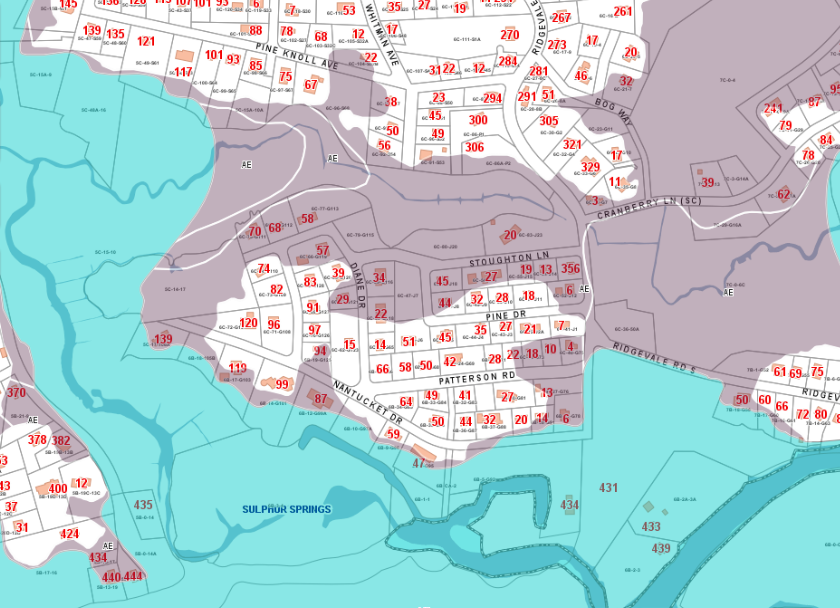

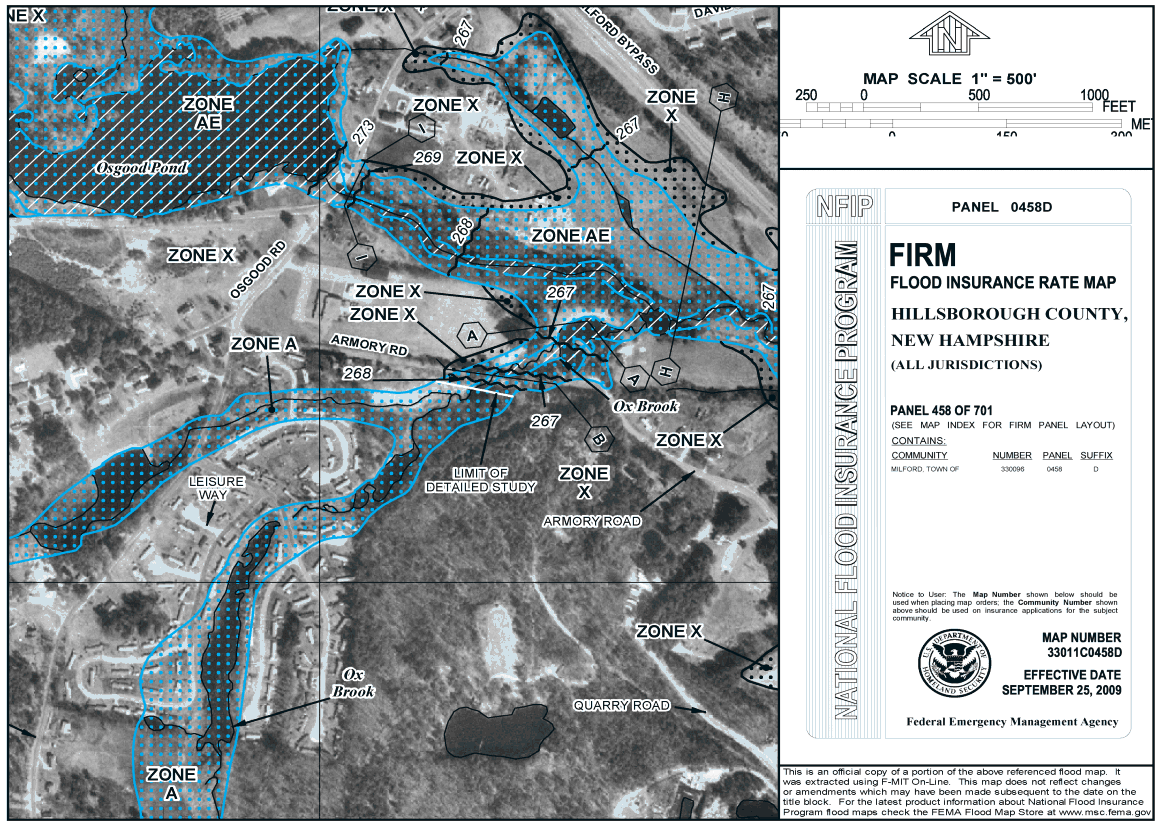

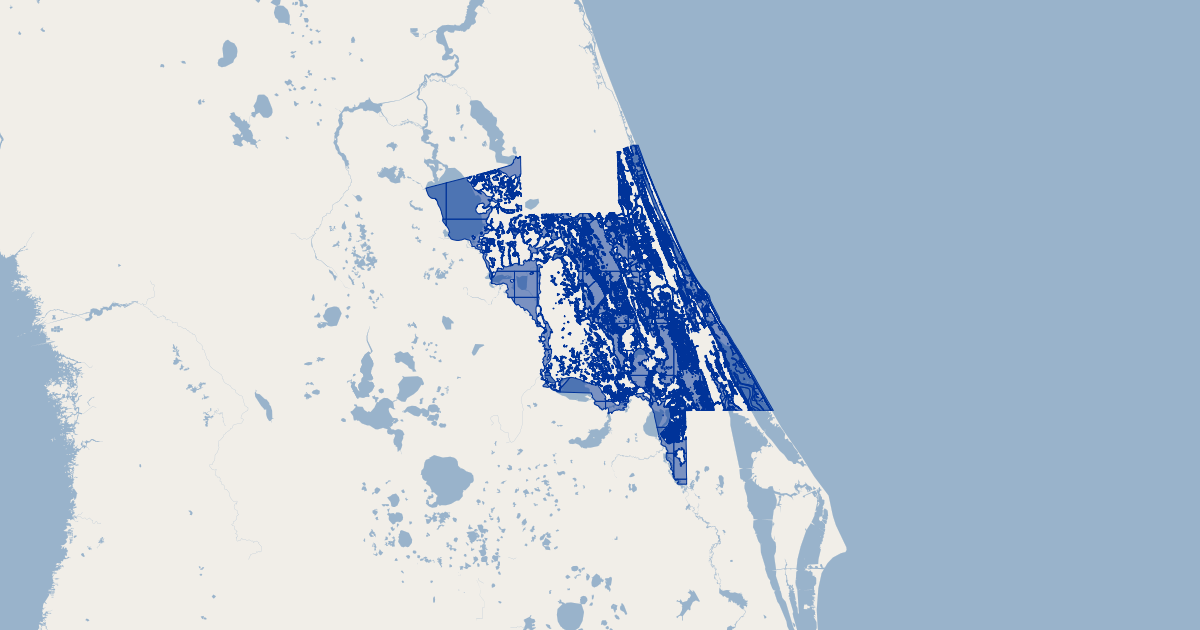

Zone AHįlood insurance rate zone that corresponds to areas of shallow flooding with average depths between one (1) and three (3) feet. Zone AEįlood insurance rate zone that corresponds with flood depths greater than three (3) feet. Zone Aįlood insurance rate zone determined by approximate methods, as no Base Flood Elevations (BFEs) are available for these areas. The following flood zone designations determine whether or not flood insurance is mandated. View your property’s flood zone by searching the Broward FEMA Flood Zone Map linked above. All areas are susceptible to flooding, although to varying degrees.

Property owners should consider purchasing a flood insurance policy, even if it is not mandated for their location.

The finalized maps are used by insurance companies for flood insurance purposes and the updated base flood elevations must be used for all new construction and substantial improvements to existing construction.īroward County residents and business owners are encouraged to view the flood maps to better understand their potential flood risk and to help identify steps they may need to take to protect against property damage and loss. Broward County Interactive FEMA Flood Zone Map (effective August 18, 2014)įEMA updated flood maps for Broward County on August 18, 2014.

0 kommentar(er)

0 kommentar(er)